Introducing AU Bank Credit Card: Your Key to Financial Flexibility

Unlock a World of Financial Convenience with AU Bank Credit Card

Credit Card: In today’s fast-paced world, having a reliable financial companion is crucial. Whether it’s managing everyday expenses, indulging in occasional luxuries, or seizing unexpected opportunities, having the right credit card can make all the difference. That’s where AU Bank Credit Card steps in, offering a myriad of benefits tailored to your lifestyle and financial needs.

Tailored Benefits

AU Bank Credit Card is designed with your convenience in mind. With a range of tailored benefits, it seamlessly adapts to your lifestyle, ensuring that you get the most out of every transaction. From cashback rewards on everyday purchases to exclusive discounts on dining, shopping, and travel, your AU Bank Credit Card opens doors to a world of savings and privileges.

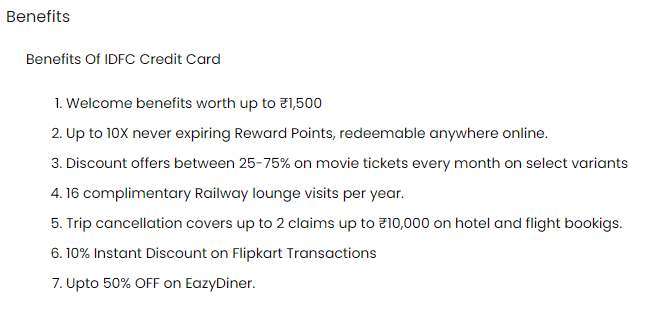

IDFC First Bank Lifetime Free Credit Card

Financial Flexibility

At AU Bank, we understand that flexibility is key when it comes to managing your finances. That’s why our credit card offers flexible repayment options, empowering you to choose a plan that suits your budget and lifestyle. Whether you prefer to pay in full each month or spread your payments over time, AU Bank Credit Card gives you the freedom to manage your finances on your terms.

Secure and Convenient

Your peace of mind is our top priority. With advanced security features and round-the-clock fraud monitoring, you can rest assured that your transactions are always safe and secure. Plus, with our user-friendly mobile app, managing your credit card has never been easier. From checking your balance to paying your bills, you can do it all with just a few taps on your smartphone.

Exceptional Customer Service

At AU Bank, we believe in going above and beyond to exceed our customers’ expectations. That’s why we offer personalized customer service that’s second to none. Whether you have a question about your account or need assistance with a transaction, our dedicated team of experts is here to help, 24/7.

Apply Today

Ready to experience the convenience and flexibility of AU Bank Credit Card? Applying is quick and easy. Simply visit our website or stop by your nearest AU Bank branch to get started. With instant approval and a seamless application process, you could be on your way to enjoying all the benefits of AU Bank Credit Card in no time.

Join the AU Bank Family

Join the millions of satisfied customers who trust AU Bank for all their banking needs. With a reputation for excellence and a commitment to innovation, AU Bank is the partner you can count on for all your financial goals. Apply for your AU Bank Credit Card today and experience the difference for yourself.

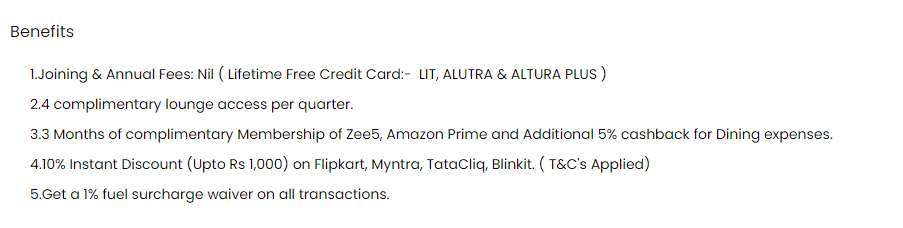

Benefits

Reward Points: Earn reward points on every transaction you make with your AU Bank Credit Card. These points can be redeemed for a variety of rewards, including gift vouchers, merchandise, or even cashback.

- Cashback Offers: Enjoy cashback rewards on specific categories such as groceries, fuel, dining, or online shopping. AU Bank often partners with merchants to provide exclusive cashback offers, allowing you to save money on your everyday expenses.

- Travel Benefits: If you’re a frequent traveler, you’ll appreciate the travel benefits that come with AU Bank Credit Card. These may include complimentary airport lounge access, travel insurance coverage, discounts on airfare or hotel bookings, and waived foreign transaction fees.

- Zero Annual Fee: Some AU Bank Credit Cards come with no annual fee, saving you money on maintenance costs while still providing you with all the benefits and rewards.

- Flexible Payment Options: AU Bank understands that everyone’s financial situation is different. That’s why they offer flexible payment options, allowing you to pay your credit card bill in full each month or opt for a convenient installment plan.

- Security Features: AU Bank Credit Cards are equipped with advanced security features to protect you against fraudulent transactions. These may include EMV chip technology, two-factor authentication, real-time transaction alerts, and the option to temporarily freeze your card if it’s lost or stolen.

- Exclusive Offers and Discounts: As an AU Bank Credit Cardholder, you’ll have access to exclusive offers and discounts at partner merchants. This could include discounts on dining, shopping, entertainment, or lifestyle services.

- 24/7 Customer Support: AU Bank is committed to providing exceptional customer service. Whether you have a question about your account, need assistance with a transaction, or want to report a lost or stolen card, their dedicated customer support team is available 24/7 to assist you.

These benefits make AU Bank Credit Card a valuable financial tool that not only provides convenience and flexibility but also helps you save money and enjoy additional perks on your everyday purchases and experiences.

Navigating the Financial Landscape: Strategies for Successful Investing

About the Brand

Established with a vision to redefine the banking experience, AU Bank stands as a beacon of innovation, trust, and customer-centricity in the financial landscape. With a commitment to excellence and a focus on empowering individuals and businesses, AU Bank has swiftly emerged as a leading player in the banking industry.

Core Values

- Customer-Centricity: At the heart of AU Bank’s philosophy lies a deep commitment to putting customers first. Every product, service, and interaction is designed with the customer’s needs and preferences in mind, ensuring a seamless and rewarding banking experience.

- Innovation: AU Bank is driven by a spirit of innovation, constantly striving to introduce new technologies, products, and solutions that enhance convenience, efficiency, and value for customers. From digital banking platforms to innovative financial products, AU Bank continues to push the boundaries of traditional banking.

- Integrity: Integrity is the cornerstone of AU Bank’s operations. With a strong emphasis on transparency, honesty, and ethical conduct, AU Bank builds enduring relationships based on trust and integrity, fostering long-term partnerships with customers, employees, and stakeholders.

- Community Engagement: AU Bank believes in giving back to the communities it serves. Through various corporate social responsibility initiatives, AU Bank actively contributes to social development, education, healthcare, and environmental sustainability, making a positive impact on society..

Innovative Products and Services

AU Bank offers a comprehensive suite of banking products and services tailored to meet the diverse needs of individuals, businesses, and institutions. From savings accounts and loans to insurance, investments, and wealth management solutions, AU Bank provides a one-stop destination for all financial requirements.

Digital Transformation

Embracing the digital revolution, AU Bank has embarked on a journey of digital transformation, leveraging technology to deliver superior banking experiences. With intuitive mobile banking apps, online account management tools, and secure digital payment solutions, AU Bank empowers customers to bank anytime, anywhere, with ease and convenience.

Award-Winning Excellence

AU Bank’s relentless pursuit of excellence has been recognized and honored by industry experts and organizations. Through its commitment to innovation, customer service, and social responsibility, AU Bank has received numerous awards and accolades, reaffirming its position as a trusted and respected banking partner.

How its Work

1. Application Process:

- To apply for an AU Bank Credit Card, individuals need to meet certain eligibility criteria, including age, income, and credit score requirements.

- Applicants can apply for a credit card online through the AU Bank website or by visiting a branch in person.

- The application process typically involves submitting personal and financial information, along with supporting documents as required by AU Bank.

2. Approval and Issuance:

- Once the application is submitted, AU Bank evaluates the applicant’s eligibility based on factors such as credit history, income, and existing debts.

- If the application is approved, AU Bank issues the credit card to the applicant. The credit limit assigned to the card is determined based on the individual’s creditworthiness.

3. Credit Limit:

- The credit limit is the maximum amount of credit that the cardholder can spend using the AU Bank Credit Card. It is determined by AU Bank based on various factors, including the individual’s income, credit history, and repayment behavior.

- The cardholder should be mindful of their credit limit and avoid exceeding it to prevent over-limit fees or declined transactions.

4. Making Purchases:

- Once the AU Bank Credit Card is activated, the cardholder can start making purchases using the card.

- The card can be used for both online and offline transactions at millions of merchants worldwide, wherever Visa or Mastercard (depending on the card network) is accepted.

5. Billing Cycle:

- AU Bank Credit Card operates on a billing cycle, typically lasting for a month.

- During the billing cycle, the cardholder can make purchases up to their credit limit. These transactions are recorded by AU Bank.

6. Statement Generation:

- At the end of each billing cycle, AU Bank generates a credit card statement detailing all transactions made during that period, including purchases, payments, fees, and interest charges (if applicable).

- The statement also specifies the payment due date and minimum amount due.

7. Repayment Options:

- The cardholder has the flexibility to choose how much of the outstanding balance to repay each month.

- They can opt to pay the full statement balance, the minimum amount due, or any amount in between.

- Paying the full statement balance by the due date helps avoid interest charges on carried-over balances.

Top 5 loans commonly availed in the India

8. Interest Charges:

- If the cardholder chooses not to pay the full statement balance by the due date, AU Bank will charge interest on the remaining balance, known as the revolving balance.

- The interest rate applied to the revolving balance is specified in the credit card terms and conditions.

9. Rewards and Benefits:

- AU Bank Credit Card may offer various rewards, cashback, discounts, and privileges on eligible transactions.

- Cardholders can earn reward points for every purchase made using the card, which can be redeemed for a range of benefits, including travel rewards, merchandise, gift vouchers, and statement credits.

10. Security Features:

- AU Bank Credit Card comes with advanced security features, including EMV chip technology, two-factor authentication, and real-time fraud monitoring, to safeguard against unauthorized transactions and identity theft.

Overall, AU Bank Credit Card offers a convenient and flexible way to manage finances, make purchases, earn rewards, and enjoy various benefits, all while providing security and peace of mind to cardholders.

Apply AU Bank Credit Card

Terms and Condition

AU Bank Credit Card Terms and Conditions

These Terms and Conditions govern the issuance and use of AU Bank Credit Cards. By applying for and using an AU Bank Credit Card, you agree to comply with these terms and conditions:

- Card Issuance: AU Bank reserves the right to approve or reject credit card applications based on its internal policies and criteria. The issuance of a credit card is subject to verification of the applicant’s identity, income, credit history, and other relevant factors.

- Card Ownership: AU Bank Credit Cards are issued for the exclusive use of the cardholder whose name appears on the card. The card is non-transferable, and the cardholder is responsible for all transactions made using the card.

- Credit Limit: AU Bank assigns a credit limit to each cardholder based on factors such as income, creditworthiness, and repayment history. The cardholder agrees not to exceed the assigned credit limit and acknowledges that AU Bank may decline transactions that exceed the credit limit.

- Billing Cycle: The billing cycle for AU Bank Credit Cards typically lasts for one month. Cardholders will receive a monthly statement detailing all transactions made during the billing cycle, along with the payment due date and minimum amount due.

- Payment Obligations: Cardholders are required to make timely payments of the outstanding balance on their credit card statement by the payment due date. Failure to pay the minimum amount due by the due date may result in late payment fees and interest charges.

- Interest Rates: AU Bank charges interest on the outstanding balance carried over from one billing cycle to the next. The applicable interest rate(s) and method of interest calculation are specified in the credit card agreement. Cardholders are advised to review the interest rate(s) and understand the implications of carrying a balance.

- Fees and Charges: AU Bank may levy various fees and charges on credit card transactions, including but not limited to annual fees, late payment fees, over-limit fees, cash advance fees, and foreign transaction fees. The schedule of fees and charges is provided to the cardholder at the time of card issuance and is subject to change with prior notice.

- Reward Program: AU Bank Credit Cards may offer a rewards program whereby cardholders earn reward points or cashback on eligible transactions. The terms and conditions of the rewards program, including earning rates, redemption options, and expiration policies, are specified in the program’s terms and conditions.

- Security and Fraud Protection: AU Bank employs various security measures to protect cardholders against unauthorized transactions and fraud. Cardholders are advised to safeguard their credit card information and report any suspected unauthorized activity to AU Bank immediately.

- Modification of Terms: AU Bank reserves the right to modify these terms and conditions, including fees, interest rates, and reward program terms, at its discretion. Any changes will be communicated to cardholders in advance, and continued use of the credit card constitutes acceptance of the modified terms.

- Governing Law: These terms and conditions are governed by the laws of the jurisdiction where AU Bank operates. Any disputes arising out of or relating to the credit card agreement shall be subject to the exclusive jurisdiction of the courts in the relevant jurisdiction.

By applying for and using an AU Bank Credit Card, you acknowledge that you have read, understood, and agreed to these terms and conditions in their entirety. For any questions or clarifications, please contact AU Bank’s customer service.

Introducing the IDFC First Bank Lifetime Credit Card: Your Key to Limitless Possibilities

Are you ready to unlock a world of convenience, rewards, and financial freedom? Look no further than the IDFC First Bank Lifetime Credit Card – the ultimate companion for your everyday transactions and lifestyle needs.

At IDFC First Bank, we understand the importance of providing our customers with unparalleled value and seamless experiences. That’s why we’ve crafted the Lifetime Credit Card, designed to cater to your diverse requirements while offering a plethora of benefits that last a lifetime.

Elevate Your Lifestyle with Exclusive Features

1. Lifetime Free Membership:

Say goodbye to annual fees and enjoy the perks of membership for a lifetime. With the IDFC First Bank Lifetime Credit Card, there are no hidden charges or renewal fees – just pure, uninterrupted benefits.

2. Generous Rewards Program:

Every swipe earns you rewards that add up quickly. Whether you’re shopping for groceries, dining out with friends, or booking your next getaway, earn reward points on every transaction and redeem them for exciting gifts, vouchers, or cashback offers.

3. Enhanced Security:

Your peace of mind is our top priority. Our Lifetime Credit Card comes with advanced security features, including EMV chip technology and PIN-based transactions, ensuring that your financial information remains secure at all times.

4. Global Acceptance:

Travel with confidence knowing that your IDFC First Bank Lifetime Credit Card is accepted worldwide. Whether you’re exploring exotic destinations or conducting business abroad, enjoy the convenience of seamless transactions wherever you go.

5. Flexible Credit Limits:

Tailored to suit your financial needs, our Lifetime Credit Card offers flexible credit limits that adapt to your spending patterns and lifestyle requirements. Enjoy the freedom to spend responsibly while managing your finances effortlessly.

Apply Now and Experience the IDFC First Bank Advantage

Ready to experience the unmatched benefits of the IDFC First Bank Lifetime Credit Card? Applying is quick and hassle-free, with instant approval and seamless integration into your existing banking relationship.